Home > Archives for Randy Grizzle > Page 5

Storms are brewing in the Atlantic. Waiting for storms to arrive is

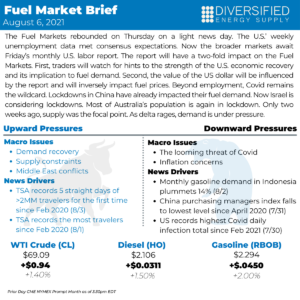

The Fuel Markets rebounded on Thursday on a light news day. The U.S.’ weekly unemployment data met consensus expectations. Now the broader markets await Friday’s monthly U.S. labor report. The report will have a two-fold impact on the Fuel Markets. First, traders will watch for hints to the strength of the U.S. economic recovery and its implication to fuel demand. Second, the value of the US dollar will be influenced by the report and will inversely impact fuel prices. Beyond employment, Covid remains the wildcard. Lockdowns in China have already impacted their fuel demand. Now Israel is considering lockdowns. Most of Australia’s population is again in lockdown. Only two weeks ago, supply was the focal point. As delta rages, demand is under pressure.

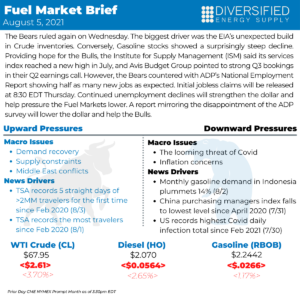

The Bears ruled again on Wednesday. The biggest driver was the EIA’s unexpected build in Crude inventories. Conversely, Gasoline stocks showed a surprisingly steep decline. Providing hope for the Bulls, the Institute for Supply Management (ISM) said its services index reached a new high in July, and Avis Budget Group pointed to strong Q3 bookings in their Q2 earnings call. However, the Bears countered with ADP’s National Employment Report showing half as many new jobs as expected. Initial jobless claims will be released at 8:30 EDT Thursday. Continued unemployment declines will strengthen the dollar and help pressure the Fuel Markets lower. A report mirroring the disappointment of the ADP survey will lower the dollar and help the Bulls.

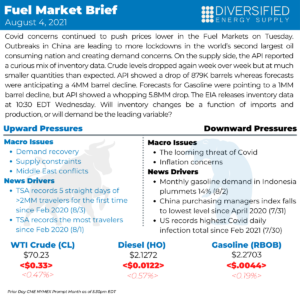

Covid concerns continued to push prices lower in the Fuel Markets on Tuesday. Outbreaks in China are leading to more lockdowns in the world’s second largest oil consuming nation and creating demand concerns. On the supply side, the API reported a curious mix of inventory data. Crude levels dropped again week over week but at much smaller quantities than expected. API showed a drop of 879K barrels whereas forecasts were anticipating a 4MM barrel decline. Forecasts for Gasoline were pointing to a 1MM barrel decline, but API showed a whopping 5.8MM drop. The EIA releases inventory data at 10:30 EDT Wednesday. Will inventory changes be a function of imports and production, or will demand be the leading variable?

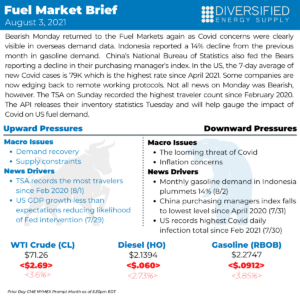

Bearish Monday returned to the Fuel Markets again as Covid concerns were clearly visible in overseas demand data. Indonesia reported a 14% decline from the previous month in gasoline demand. China’s National Bureau of Statistics also fed the Bears reporting a decline in their purchasing manager’s index. In the US, the 7-day average of new Covid cases is 79K which is the highest rate since April 2021. Some companies are now edging back to remote working protocols. Not all news on Monday was Bearish, however. The TSA on Sunday recorded the highest traveler count since February 2020. The API releases their inventory statistics Tuesday and will help gauge the impact of Covid on US fuel demand.

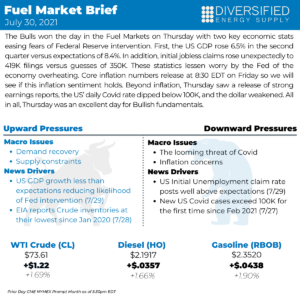

The Bulls won the day in the Fuel Markets on Thursday with two key economic stats easing fears of Federal Reserve intervention. First, the US GDP rose 6.5% in the second quarter versus expectations of 8.4%. In addition, initial jobless claims rose unexpectedly to 419K filings versus guesses of 350K. These statistics lessen worry by the Fed of the economy overheating. Core inflation numbers release at 8:30 EDT on Friday so we will see if this inflation sentiment holds. Beyond inflation, Thursday saw a release of strong earnings reports, the US’ daily Covid rate dipped below 100K, and the dollar weakened. All in all, Thursday was an excellent day for Bullish fundamentals.

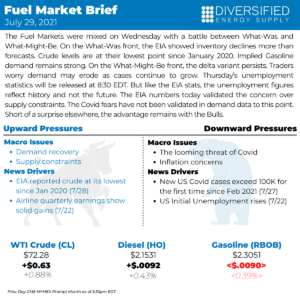

The Fuel Markets were mixed on Wednesday with a battle between What-Was and What-Might-Be. On the What-Was front, the EIA showed inventory declines more than forecasts. Crude levels are at their lowest point since January 2020. Implied Gasoline demand remains strong. On the What-Might-Be front, the delta variant persists. Traders worry demand may erode as cases continue to grow. Thursday’s unemployment statistics will be released at 8:30 EDT. But like the EIA stats, the unemployment figures reflect history and not the future. The EIA numbers today validated the concern over supply constraints. The Covid fears have not been validated in demand data to this point. Short of a surprise elsewhere, the advantage remains with the Bulls.

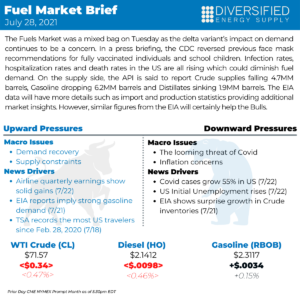

The Fuels Market was a mixed bag on Tuesday as the delta variant’s impact on demand continues to be a concern. In a press briefing, the CDC reversed previous face mask recommendations for fully vaccinated individuals and school children. Infection rates, hospitalization rates and death rates in the US are all rising which could diminish fuel demand. On the supply side, the API is said to report Crude supplies falling 4.7MM barrels, Gasoline dropping 6.2MM barrels and Distillates sinking 1.9MM barrels. The EIA data will have more details such as import and production statistics providing additional market insights. However, similar figures from the EIA will certainly help the Bulls.

If you find it difficult to understand fuel pricing methods, you’re not

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075