If you find it difficult to understand fuel pricing methods, you’re not alone. Many people find them confusing. There are so many questions to answer in choosing a pricing Method for your fuel: What are the ways to price the fuel I buy? Which is best suited for my needs? Are there pitfalls I need to avoid?

Here’s what you need to consider.

Choosing a Pricing Method For Your Fuel

Index-Based Pricing

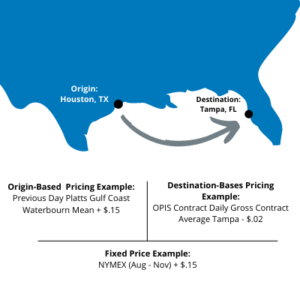

When it comes to index-based pricing, you are primarily looking at two general categories: Origin based and destination-based pricing.

Origin-Based Pricing

Origin-based pricing is established based on when the fuel first leaves the refinery and enters the distribution system. To calculate origin-based pricing, you have to take into account the region from which the fuel originates – for example, the Gulf Coast, New York Harbor, or Chicago – and the cost of shipping the fuel into its destination market.

There are several costs that are included in the differential formula related to destination marketing. It includes things such as:

- Pipeline tariffs

- Vessel or barge costs

- Time value of money

- Line loss estimates

The fuel supplier will also account for the market-specific dynamics for the fuel’s final destination. As an example, if we look at thinly-supplied markets, we see these will have a premium included in the differential equation because it has to reflect the supply and demand of the area. If it’s historically out-of-sync in the destination market, that premium will go up.

The final price is typically based on the prior day’s closing cost. Each index provider will calculate the “trading window” in a unique way, meaning there will be some variations in the calculations, depending on the index selected. Some of the most common origin-based indices include:

To better understand origin-based quotes, let’s look at the example of: Previous Day Platts Gulf Coast Mean + $0.080. This translates to a pricing formula that uses Platts’ index measure. The pricing is then set using the mean – or average, as opposed to the low or high – for the prior day’s eligible trading window. Following this equation, the final price the customer would pay is $0.08 per gallon above the index posting.

So, who should use origin-based pricing? The foundations of this pricing method are based on the economics of the refinery or the shipper, meaning trades of thousands of barrels, rather than gallons. Those best suited for this pricing method have large volumes of a single product in a specific market.

Destination-Based Pricing

By far the most commonly used pricing method for negotiating supply agreements is destination-based pricing. Destination-based pricing is set to a specific market. While origin-based pricing assumes market dynamics in their differential, destination-based pricing reflects the actual wholesale pricing and those dynamics.

The index provider will collect the participating wholesale prices at the truck loading racks in a specific market. The index will divide the list of the wholesale prices to include only the prices that meet the designated profile.

There are several versions of this segmentation:

Mathematical Formula

- Low: The lowest wholesale price within the subset.

- Average: The average wholesale price within the subset.

- High: The highest wholesale price within the subset.

Timing Segmentation

- Closing: Whole prices for the subset as of 5:59 p.m., or the prices that are in place before the effective daily price change at 6:00 p.m.

- Contract: Whole prices for the subset as of 10:00 a.m.

- Calendar: Whole prices for the subset as of 11:59 p.m.

Marketing Segmentation

- Branded: Includes only fuel prices designated by a specific brand, like BP, Citgo, Exxon, or Shell. This fuel can only be delivered to those branded retail locations.

- Unbranded: Excludes all branded prices

- Top Tier: Includes only prices meeting the stands of the TOP TIER™ program designation.

Payment Segmentation

- Gross: Index price calculations that are based on the wholesale price BEFORE early payment discounts are applied.

- Net: Index price calculations based on the wholesale price AFTER payment discounts are applied.

To understand destination-based pricing, let’s look at the example of OPIS Daily Gross Contract Average Tampa, FL – $0.02. This equation indicates a price based on the Oil Price Information Services wholesale price index. In that index, you will find the average of the wholesale prices in Tampa, FL as of 10:00 a.m., minus $0.02 per gallon.

When using a destination-based index for your pricing method, the most common ones are OPIS Wholesale Rack prices and DTN FastRacks. Below is an example of how wholesale prices would be gathered and the value of various index value segmentation.

| Market: | Denver, CO | ||||

| Date: | 7/20/2021 | ||||

| For Prices Effective: | 10:00 AM | ||||

| Product: | 85 E10 Gasoline | ||||

| Suppliers | Payment Discount | Branded | Top Tier | Gross Price | Net Price |

| Supplier A | N | Y | $2.5171 | $2.5171 | |

| Supplier B | 1% | N | $2.5762 | $2.5504 | |

| Supplier C | N | $2.5682 | $2.5682 | ||

| Supplier D | Y | $2.5536 | $2.5536 | ||

| Supplier E | N | $2.5601 | $2.5601 | ||

| Supplier F | Y | $2.5601 | $2.5601 | ||

| Supplier G | N | Y | $2.5683 | $2.5683 | |

| Supplier H | N | $2.5353 | $2.5353 | ||

| Supplier I | Y | $2.5583 | $2.5583 | ||

| Supplier J | N | $2.5217 | $2.5217 | ||

| Supplier K | 1% | N | $2.5571 | $2.5315 | |

| Supplier L | N | Y | $2.5135 | $2.5135 | |

| Low | $2.5135 | $2.5135 | |||

| Average | $2.5491 | $2.5448 | |||

| High | $2.5762 | $2.5683 | |||

| Unbranded Low | $2.5135 | $2.5135 | |||

| Unbranded Average | $2.5464 | $2.5407 | |||

| Top Tier Low | $2.5135 | $2.5135 | |||

| Top Tier Average | $2.5330 | $2.5330 |

Cost Plus Pricing

Another pricing method you can use is Cost Plus Pricing. It’s the easiest pricing method, by far, because the fuel buyer simply pays the supplier a margin above and beyond the supplier’s own price. Typically, any negotiations about the price center on the quoted margin.

As far as the buyer is concerned, this is the riskiest pricing method. The supplier doesn’t need to worry if a load is sourced competitively because they can simply apply the margin to however they purchase.

As a buyer, your supplier may buy well overall, but are they buying well on your loads? For example, is your supplier using your loads to cover unattractive contracts on their side? And how often do you verify your prices by looking at the supplier’s invoice?

That being said, not all Cost Plus arrangements are bad. However, you can’t be naive. With this pricing method, there are inherent dangers in the arrangements. If you choose to employ this method, be sure to periodically audit the supplier’s invoice. You can use Spot Prices from other suppliers to gauge the competitiveness of your deliveries.

Spot Quotes

When you buy using the spot method, you receive daily prices from a number of vendors and choose the vendor with the lowest price on that given day. If you are only focused on getting the lowest price possible, this is a great pricing method for you. However, there are still risks.

For this method to be successful, you have to have carriers who can deliver to you on the same day as your order. This presents the first challenge – there is currently a fuel driver shortage. Choosing this method could mean you don’t have fuel to operate your business, simply because you want to save $0.01 per gallon. When looking at the relative risk, consider the cost of an hour of your driver’s time. Saving that $0.01 per gallon means saving $75 on a $20,000 fuel order. If you use an hour of your driver’s time waiting for fuel delivery, you could find yourself wasting far more than $75.

Another consideration with the spot method is the exposure to risk when there’s a supply issue. Consider the impact of the Colonial Pipeline failure in May 2021 or the fuel supply impact of a hurricane. In these types of events, price shoppers are often the first to be cast off by marketers who are now focused on serving contracted customers during the crisis. By choosing this method, you could be putting your business in harm’s way. Weigh the risks carefully.

Fixed Pricing

With fixed pricing, you lock in your fuel price so that risks associated with volatile fuel prices are mitigated. This method makes good sense only if the buyer has price risk exposure. The key to using the fixed pricing method is to first understand your risks. Second, take the time to understand the key components of your fixed price offer:

NYMEX Strip

Typically, fixed prices are usually set against CME’s New York Mercantile futures trading. That means the price you pay will be a function of the months in which you wish to accept delivery. The “Strip” will be the month or months following the month of delivery. For example, if a buyer wants to lock prices for July through October, they will use a futures strip made up of futures settling in the months of August through October.

Differential

Similar to origin-based pricing, a NYMEX price formula will include a differential against the NYMEX strip for the months when you want to accept a delivery. An example of a NYMEX price quote would be NYMEX + $0.15. The quote would also include the months when you take delivery and the volumes that you are committing to for this formula.

Take or Pay

With a take or pay setup, you will be billed for the fuel whether you receive deliveries or not. The risk is overcommitting on volume. Leave yourself a buffer in case your usage is less than expected.

Margin Calls

Margin calls are deposits made by the transacting parties to ensure each party to the trade has skin in the game. If the market collapses, the fuel buyer could purchase fuel cheaper in the open market than with their contracted fixed price. A margin call would be sent as a deposit to the supplier to ensure the buyer doesn’t walk away from the deal. Conversely, if the market spikes, the fuel supplier could sell to another buyer at a higher market price than their contracted price with the original buyer. A margin call would be a deposit paid to the buyer to ensure the seller fulfills their commitment.

While not all fuel suppliers require margin calls, your supplier might. If they do, be sure the margin call is reciprocal. You don’t want to be forced to send a deposit to the supplier without the supplier also being obligated to do the same for you.

Establishing a fixed price position can be an effective tool for eliminating price risks. Before you enter into a fixed price agreement, make sure you have buy-in from key executives within your company, such as the Risk Management Office and CFO. If you present your options properly, these discussions will be focused on risk management, rather than market speculation. Diversification can help in framing those conversations, as well as educating your company executives on approaches to execute the fixed price plan when ready.

Final Thoughts on Choosing a Pricing Method For Your Fuel

Deciding which fuel pricing method is right for you requires that you be mindful of your company and your needs. Identify what is most important to you: is it removing risk or saving a buck? Is it getting the best price at wholesale or balancing security of supply in times of crisis? As you identify your needs, you will be led to the right method for you.

If you’re having trouble identifying which pricing method is right for you, give us a call. We can help you analyze your business and what your needs are. Rather than guessing, call us and we’ll help you find the best option for you!