Home > API

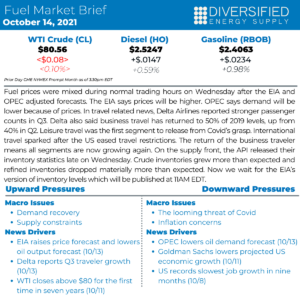

Fuel prices were mixed during normal trading hours on Wednesday after the EIA and OPEC adjusted forecasts.

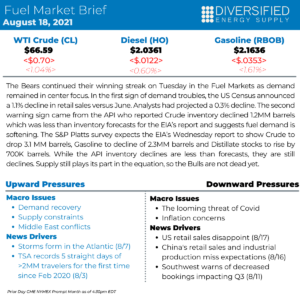

The Bears continued their winning streak on Tuesday in the Fuel Markets as demand remained in center focus. In the first sign of demand troubles, the US Census announced a 1.1% decline in retail sales versus June. Analysts had projected a 0.3% decline. The second warning sign came from the API who reported Crude inventory declined 1.2MM barrels which was less than inventory forecasts for the EIA’s report and suggests fuel demand is softening. The S&P Platts survey expects the EIA’s Wednesday report to show Crude to drop 3.1 MM barrels, Gasoline to decline of 2.3MM barrels and Distillate stocks to rise by 700K barrels. While the API inventory declines are less than forecasts, they are still declines. Supply still plays its part in the equation, so the Bulls are not dead yet.

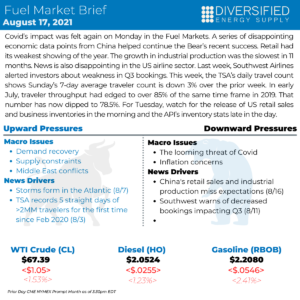

Covid’s impact was felt again on Monday in the Fuel Markets. A series of disappointing economic data points from China helped continue the Bear’s recent success. Retail had its weakest showing of the year. The growth in industrial production was the slowest in 11 months. News is also disappointing in the US airline sector. Last week, Southwest Airlines alerted investors about weakness in Q3 bookings. This week, the TSA’s daily travel count shows Sunday’s 7-day average traveler count is down 3% over the prior week. In early July, traveler throughput had edged to over 85% of the same time frame in 2019. That number has now dipped to 78.5%. For Tuesday, watch for the release of US retail sales and business inventories in the morning and the API’s inventory stats late in the day.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075