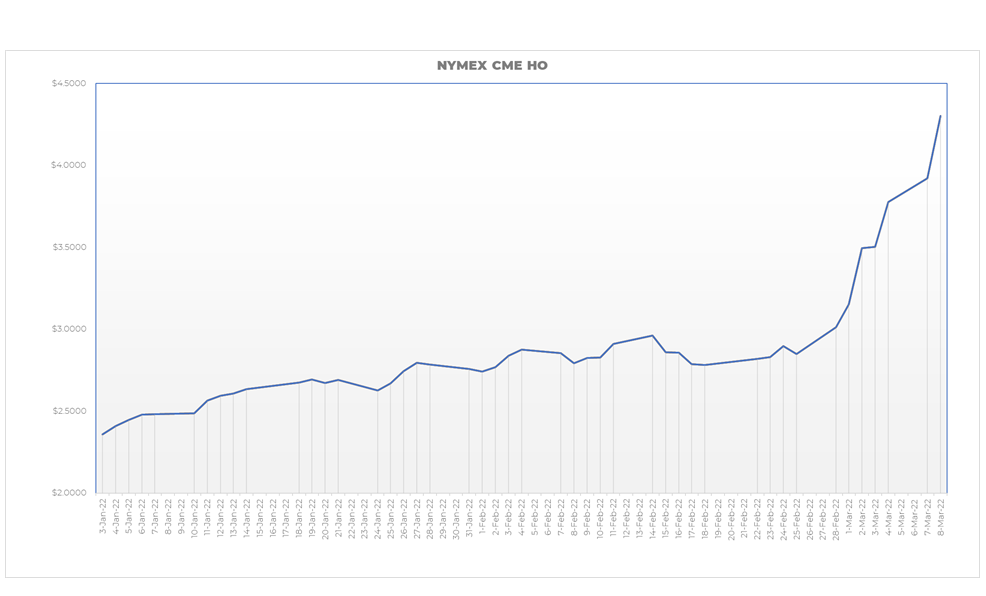

Fuel prices are rising again this morning. As of this post at 11:05 am EST on March 8, 2022, West Texas crude is trading at $125 per barrel. Diesel fuel is trading approximately $.43 per gallon higher than yesterday, meaning a full truck load of diesel will be $3K more expensive on Wednesday than when the markets closed on Monday.

To illustrate the cumulative impact of fuel markets so far this year, that same load of diesel purchased on January 3rd would have been roughly $15K cheaper than the same load purchased on Wednesday, March 9th.

What Impacts are We Seeing?

Beyond the obvious cost implications, there are other impacts fuel buyers need to understand:

· Increased Demand: We are seeing a significant increase in customer demand as they try to purchase fuel today to avoid the ever-escalating price waiting for them tomorrow.

· Reduced Supply Availability: The impact is reversed for inventory position holders. A barrel released today is worth less than the same barrel sold tomorrow. The natural reaction from inventory position holders is to hold back inventory to realize higher gains for the same barrel of fuel tomorrow.

To be clear, this is not to say the position holders are bad people. The physical barrel is only one piece of the equation position holders must balance. The other cost component is their hedge positions which are designed to offset the negative impact of market price fluctuations. If they release more barrels today than they have in offsetting hedges, it is not only opportunity cost that impacts the inventory position holder, but they could lose significantly on the hedge-side of their positions.

In short, for a variety of reasons inventory position holders will hold back inventory thereby reducing supply availability and increasing consumer costs.

· Increased Carrier Demand: The spike in demand coupled with restrained supplies is also impacting overall carrier availability. Carriers are being asked to fill every fuel tank possible while chasing limited supply options at the rack. Drivers are waiting in long lines to load, and often must switch terminals after long waiting times because supply sources are strained. Overall carrier availability is suffering in this environment.

· Increased Uncertainty: Unfortunately, we do not know how long this crisis will last. We do not know how nations will ultimately respond to Russia’s aggression. We do not know how Putin will react to the restraints attempted to be placed on him. This uncertainty will remain with us for some time, which will lead to conservative approaches by inventory holders and continued price volatility.

· Increased Fuel Surcharges: The cost of fuel is up 40% since the end of February alone. Expect to see your fuel surcharges to jump significantly.

What is a Fuel Buyer to Do?

· Do not panic: Supply allocations are challenging but not impossible. It is not as dire a situation as the Southeast faced after the Colonial Pipeline outage in May 2021. There is no need to grab your grocery bags and head to your closest gas station.

· Follow DES’ Guidelines: Take time to review DES’ articles Maintain Timely Deliveries and Driver Shortages for tips on how to manage your fuel tanks during challenging times.

· Review Your Price Risk Management policies: DES is not currently recommending locking in prices for extended periods at wartime valuations. Nonetheless, the current environment will expose where your company is at risk. Learn from the lesson the market has given. DES recommends a strategic and thoughtful approach to price risk management, not knee-jerk reactions to price escalations. Apply those lessons to your business. Let us know if you need help in creating an effective plan to mitigate your fuel price risks.

In challenging times it is important to know you are working with a strong partner. Diversified wants to be that partner. Please let know us how we can assist.