Home > Market Brief > Page 6

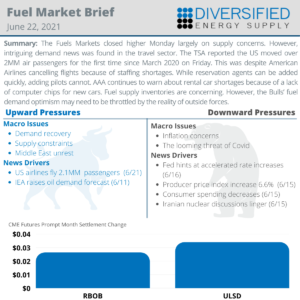

The Fuels Markets closed higher Monday largely on supply concerns. However, intriguing demand news was found in the travel sector. The TSA reported the US moved over 2MM air passengers for the first time since March 2020 on Friday. This was despite American Airlines cancelling hundreds of flights because of staffing shortages. While reservation agents can be added quickly, adding pilots cannot. AAA continues to warn about rental car shortages because of a lack of computer chips for new cars. Fuel supply inventories are concerning. However, the Bulls’ fuel demand optimism may need to be throttled by the reality of outside forces.

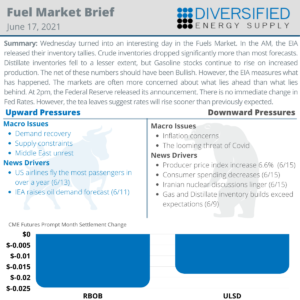

Wednesday turned into an interesting day in the Fuels Market. In the AM, the EIA released their inventory levels. Crude inventories dropped significantly more than most forecasts. Distillate inventories fell to a lesser extent, but Gasoline stocks continue to rise on increased production. The net of these numbers should have been Bullish. However, the EIA measures what has happened. The markets are often more concerned about what lies ahead than what lies behind. At 2pm, the Federal Reserve released its announcement. There is no immediate change in Fed Rates. However, the tea leaves suggest rates will rise sooner than previously expected.

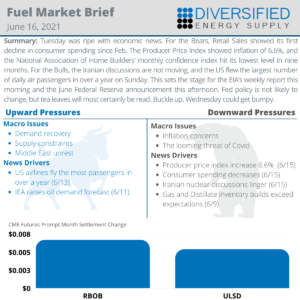

Tuesday was ripe with economic news. For the Bears, Retail Sales showed its first decline in consumer spending since Feb. The Producer Price Index showed inflation of 6.6%, and the National Association of Home Builders’ monthly confidence index hit its lowest level in nine months. For the Bulls, the Iranian discussions are not moving, and the US flew the largest number of daily air passengers in over a year on Sunday. This sets the stage for the EIA’s weekly report this morning and the June Federal Reserve announcement this afternoon. Fed policy is not likely to change, but tea leaves will most certainly be read. Buckle up. Wednesday could get bumpy.

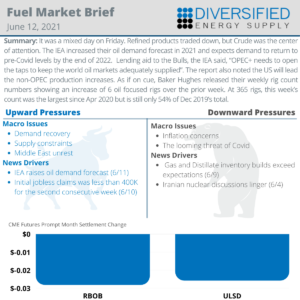

It was a mixed day on Friday. Refined products traded down, but Crude was the center of attention. The IEA increased their oil demand forecast in 2021 and expects demand to return to pre-Covid levels by the end of 2022. Lending aid to the Bulls, the IEA said, “OPEC+ needs to open the taps to keep the world oil markets adequately supplied”. The report also noted the US will lead the non-OPEC production increases. As if on cue, Baker Hughes released their weekly rig count numbers showing an increase of 6 oil focused rigs over the prior week. At 365 rigs, this week’s count was the largest since Apr 2020 but is still only 54% of Dec 2019’s total.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075