Home > Market Brief > Page 10

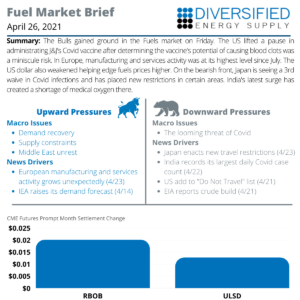

The Bulls gained ground in the Fuels market on Friday. The US lifted a pause in administrating J&J’s Covid vaccine after determining the vaccine’s potential of causing blood clots was a miniscule risk. In Europe, manufacturing and services activity was at its highest level since July. The US dollar also weakened helping edge fuels prices higher. On the bearish front, Japan is seeing a 3rd waive in Covid infections and has placed new restrictions in certain areas. India’s latest surge has created a shortage of medical oxygen there.

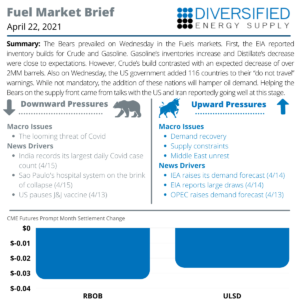

The Bears prevailed on Wednesday in the Fuels markets First, the EIA reported inventory builds for Crude and Gasoline. Gasoline’s inventories increase and Distillate’s decrease were close to expectations. However, Crude’s build contrasted with an expected decrease of over 2MM barrels. Also on Wednesday, the US government added 116 countries to their “do not travel” warnings. While not mandatory, the addition of these nations will hamper oil demand. Helping the Bears on the supply front came from talks with the US and Iran reportedly going well at this stage.

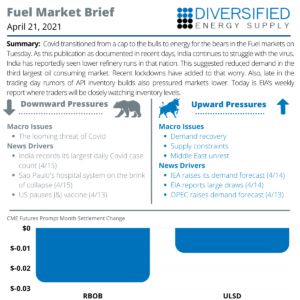

Covid transitioned from a cap to the bulls to energy for the bears in the Fuel markets on Tuesday. As this publication as documented in recent days, India continues to struggle with the virus. India has reportedly seen lower refinery runs in that nation. This suggested reduced demand in the third largest oil consuming market. Recent lockdowns have added to that worry. Also, late in the trading day rumors of API inventory builds also pressured markets lower. Today is EIA’s weekly report where traders will be closely watching inventory levels.

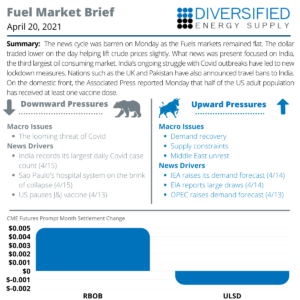

The news cycle was barren on Monday as the Fuels markets remained flat. The dollar traded lower on the day helping lift crude prices slightly. What news was present focused on India, the third largest oil consuming market. India’s ongoing struggle with Covid outbreaks have led to new lockdown measures. Nations such as the UK and Pakistan have also announced travel bans to India. On the domestic front, the Associated Press reported Monday that half of the US adult population has received at least one vaccine dose.

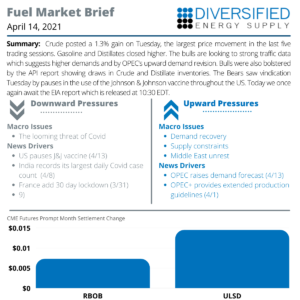

Crude posted a 1.3% gain on Tuesday, the largest price movement in the last five trading sessions. Gasoline and Distillates closed modestly higher. The bulls are looking to strong traffic data which suggests higher demands and by OPEC’s upward demand revision. Bulls were also bolstered by the API report showing draws in Crude and Distillate inventories. The Bears saw vindication Tuesday by pauses in the use of the Johnson & Johnson vaccine throughout the US. Today we once again await the EIA report which is released at 10:30 EDT.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075