Home > Archives for Randy Grizzle > Page 6

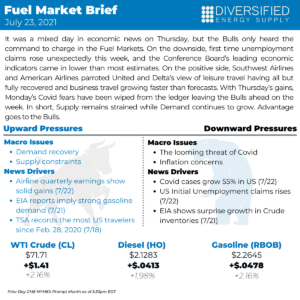

It was a mixed day in economic news on Thursday, but the Bulls only heard the command to charge in the Fuel Markets. On the downside, first time unemployment claims rose unexpectedly this week, and the Conference Board’s leading economic indicators came in lower than most estimates. On the positive side, Southwest Airlines and American Airlines parroted United and Delta’s view of leisure travel having all but fully recovered and business travel growing faster than forecasts. With Thursday’s gains, Monday’s Covid fears have been wiped from the ledger leaving the Bulls ahead on the week. In short, Supply remains strained while Demand continues to grow. Advantage Bulls.

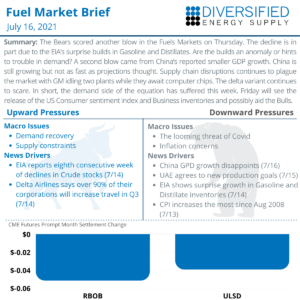

The Bears scored another blow in the Fuels Markets on Thursday. The decline is in part due to the EIA’s surprise builds in Gasoline and Distillates. Are the builds an anomaly or hints to trouble in demand? A second blow came from China’s reported smaller GDP growth. China is still growing but not as fast as projections thought. Supply chain disruptions continues to plague the market with GM idling two plants while they await computer chips. The delta variant continues to scare. In short, the demand side of the equation has suffered this week. Friday will see the release of the US Consumer sentiment index and Business inventories and possibly aid the Bulls.

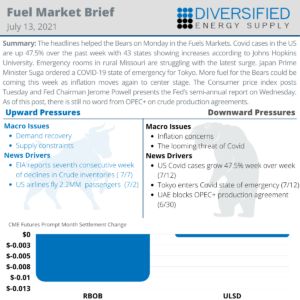

The headlines helped the Bears on Monday in the Fuels Markets. Covid cases in the US are up 47.5% over the past week with 43 states showing increases according to Johns Hopkins University. Emergency rooms in rural Missouri are struggling with the latest surge. Japan Prime Minister Suga ordered a COVID-19 state of emergency for Tokyo. More fuel for the Bears could be coming this week as inflation moves again to center stage. The Consumer price index posts Tuesday and Fed Chairman Jerome Powell presents the Fed’s semi-annual report on Wednesday. As of this post, there is still no word from OPEC+ on crude production agreements. The longer and more bitter the disagreements, the more ground the Bears gain.

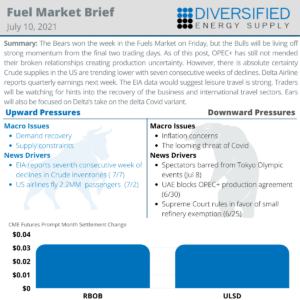

The Bears won the week in the Fuels Market on Friday, but the Bulls will be living off strong momentum from the final two trading days. As of this post, OPEC+ has still not mended their broken relationships creating production uncertainty in the market. However, there is absolute certainty Crude supplies in the US are trending lower with seven consecutive weeks of declines. Delta Airline’s reports quarterly earnings next week. The EIA data would suggest leisure travel is strong. Traders will be watching for hints into the recovery of the business and international travel sectors. Ears will also be focused on Delta’s take on the delta Covid variant.

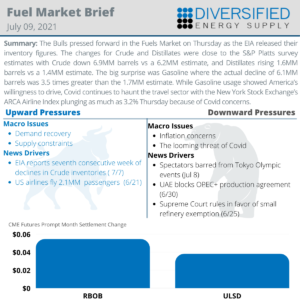

The Bulls pressed forward in the Fuels Market on Thursday as the EIA released their inventory figures. The changes for Crude and Distillates were close to the S&P Platts survey estimates with Crude down 6.9MM barrels vs a 6.2MM estimate, and Distillates rising 1.6MM barrels vs a 1.4MM estimate. The big surprise was Gasoline where the actual decline of 6.1MM barrels was 3.5 times greater than the 1.7MM estimate. While Gasoline usage showed America’s willingness to drive, Covid continues to haunt the travel sector with the New York Stock Exchange’s ARCA Airline Index plunging as much as 3.2% Thursday because of Covid concerns.

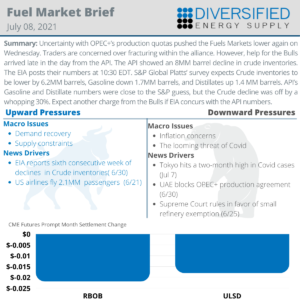

Uncertainty with OPEC+’s production quotas pushed the Fuels Markets lower again on Wednesday. Traders are concerned over fracturing within the alliance. However, help for the Bulls arrived late in the day from the API. The API showed an 8MM barrel decline in crude inventories. The EIA posts their numbers at 10:30 EDT. S&P Global Platts’ survey expects Crude inventories to be lower by 6.2MM barrels, Gasoline down 1.7MM barrels, and Distillates up 1.4 MM barrels. API’s Gasoline and Distillate numbers were close to the S&P guess, but the Crude decline was off by a whopping 30%. Expect another charge from the Bulls if EIA concurs with the API numbers.

Tropical Storm Elsa will impact the western side of the Florida peninsula

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075