Home > Market Brief > Page 8

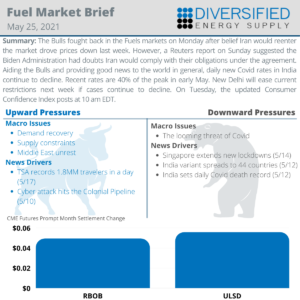

The Bulls fought back in the Fuels markets on Monday after belief Iran would reenter the market drove prices down last week. However, a Reuters report on Sunday suggested the Biden Administration had doubts Iran would comply with their obligations under the agreement. Aiding the Bulls and providing good news to the world in general, daily new Covid rates in India continue to decline. Recent rates are 40% of the peak in early May. New Delhi will ease current restrictions next week if cases continue to decline. On Tuesday, the updated Consumer Confidence Index posts at 10 am EDT.

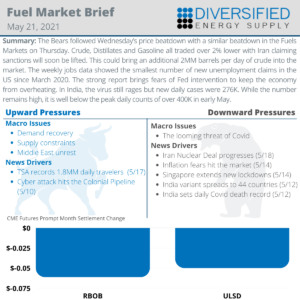

The Bears followed Wednesday’s price beatdown with a similar beatdown in the Fuels Markets on Thursday. Crude, Distillates and Gasoline all traded over 2% lower with Iran claiming sanctions will soon be lifted. This could bring an additional 2MM barrels per day of crude into the market. The weekly jobs report showed the smallest number of new unemployment claims in the US since Covid. The strong report brings fears of Fed intervention to keep the economy from overheating. In India, the virus still rages but new daily cases were 276K. While the number remains high, it is well below the peak daily counts of over 400K in early May.

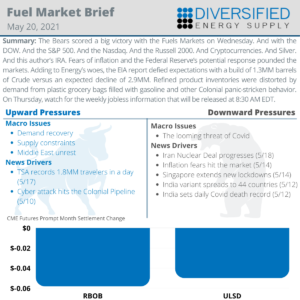

The Bears scored a big victory with the Fuels Markets on Wednesday. And with the DOW. And the S&P 500. And the Nasdaq. And the Russell 2000. And Cryptocurrencies. And Silver. And this author’s IRA. Fears of inflation and the Federal Reserve’s potential response pounded the markets. Adding to Energy’s woes, the EIA report defied expectations with a build of 1.3MM barrels of Crude versus an expected decline of 2.9MM. Refined product inventories were distorted by demand from plastic grocery bags filled with gasoline and other Colonial panic-stricken behavior during the past week. Thursday the weekly jobless information will be released at 8:30 AM EDT.

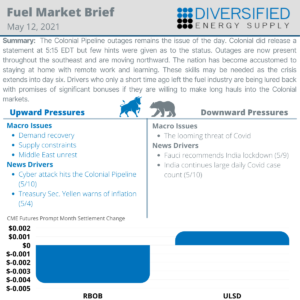

The Colonial Pipeline outages remains the issue of the day. Colonial did release a statement at 5:15 EDT but few hints were given as to the status. Outages are now present throughout the southeast and are moving northward. The nation has become accustomed to staying at home with remote work and learning. These skills may be needed as the crisis extends into day six. Drivers who only a short time ago left the fuel industry are being lured back with promises of significant bonuses if they are willing to make long hauls into the Colonial markets.

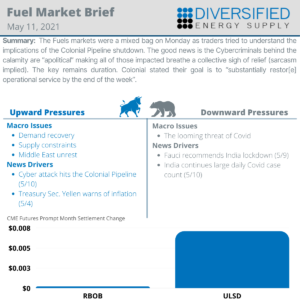

The Fuels markets were a mixed bag on Monday as traders tried to understand the implications of the Colonial Pipeline shutdown. The good news is the Cybercriminals behind the calamity are “apolitical” making all of those impacted breathe a collective sigh of relief (sarcasm implied). The key remains duration. Colonial stated their goal is to “substantially restor[e] operational service by the end of the week”.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075