Home > Market Update

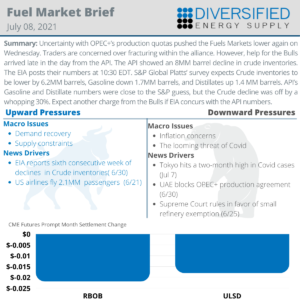

Uncertainty with OPEC+’s production quotas pushed the Fuels Markets lower again on Wednesday. Traders are concerned over fracturing within the alliance. However, help for the Bulls arrived late in the day from the API. The API showed an 8MM barrel decline in crude inventories. The EIA posts their numbers at 10:30 EDT. S&P Global Platts’ survey expects Crude inventories to be lower by 6.2MM barrels, Gasoline down 1.7MM barrels, and Distillates up 1.4 MM barrels. API’s Gasoline and Distillate numbers were close to the S&P guess, but the Crude decline was off by a whopping 30%. Expect another charge from the Bulls if EIA concurs with the API numbers.

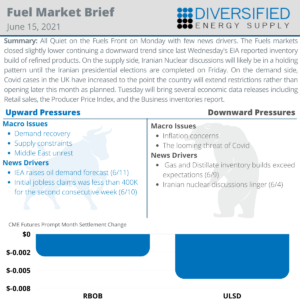

All Quiet on the Fuels Front on Monday with few news drivers. The Fuels markets closed slightly lower continuing a downward trend since last Wednesday’s EIA reported inventory build of refined products. On the supply side, Iranian Nuclear discussions will likely be in a holding pattern until the Iranian presidential elections are completed on Friday. On the demand side, Covid cases in the UK have increased to the point the country will extend restrictions rather than opening later this month as planned. Tuesday will bring several economic data releases including Retail sales, the Producer Price Index, and the Business inventories report.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075