Home > Archives for Randy Grizzle > Page 8

Tuesday was ripe with economic news. For the Bears, Retail Sales showed its first decline in consumer spending since Feb. The Producer Price Index showed inflation of 6.6%, and the National Association of Home Builders’ monthly confidence index hit its lowest level in nine months. For the Bulls, the Iranian discussions are not moving, and the US flew the largest number of daily air passengers in over a year on Sunday. This sets the stage for the EIA’s weekly report this morning and the June Federal Reserve announcement this afternoon. Fed policy is not likely to change, but tea leaves will most certainly be read. Buckle up. Wednesday could get bumpy.

All Quiet on the Fuels Front on Monday with few news drivers. The Fuels markets closed slightly lower continuing a downward trend since last Wednesday’s EIA reported inventory build of refined products. On the supply side, Iranian Nuclear discussions will likely be in a holding pattern until the Iranian presidential elections are completed on Friday. On the demand side, Covid cases in the UK have increased to the point the country will extend restrictions rather than opening later this month as planned. Tuesday will bring several economic data releases including Retail sales, the Producer Price Index, and the Business inventories report.

It was a mixed day on Friday. Refined products traded down, but Crude was the center of attention. The IEA increased their oil demand forecast in 2021 and expects demand to return to pre-Covid levels by the end of 2022. Lending aid to the Bulls, the IEA said, “OPEC+ needs to open the taps to keep the world oil markets adequately supplied”. The report also noted the US will lead the non-OPEC production increases. As if on cue, Baker Hughes released their weekly rig count numbers showing an increase of 6 oil focused rigs over the prior week. At 365 rigs, this week’s count was the largest since Apr 2020 but is still only 54% of Dec 2019’s total.

You can pack hope and expectations into a forecast, but reality sometimes ruins the party. Such was the case in the Fuels Markets on Wednesday. The common belief was drivers would break from their quarantined chains and rush to siphon gas supplies in the launch of the busy driving season. However, the EIA’s inventory numbers produced doubts. Crude declined by 5.2MM barrels over last week. Gasoline and Distillates increased a whopping 7.0MM and 4.4MM barrels respectively. This is not to say the Bears have finally won. However, the Bulls took it on the chin without doubt. Thursday’s focus will be the Weekly Jobless Claims and Core CPI.

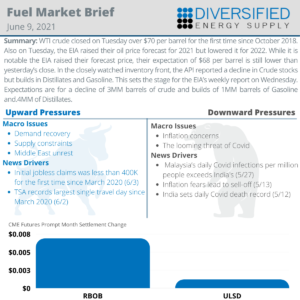

WTI crude closed on Tuesday over $70 per barrel for the first time since October 2018. Also on Tuesday, the EIA raised their oil price forecast for 2021 but lowered it for 2022. While it is notable the EIA raised their forecast price, their expectation of $68 per barrel is still lower than yesterday’s close. In the closely watched inventory front, the API reported a decline in Crude stocks but builds in Distillates and Gasoline. This sets the stage for the EIA’s weekly report on Wednesday. Expectations are for a decline of 3MM barrels of crude and builds of 1MM barrels of Gasoline and.4MM of Distillates.

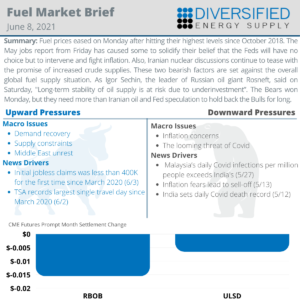

Fuel prices eased on Monday after hitting their highest levels since October 2018. The May jobs report from Friday has caused some to solidify their belief that the Feds will have no choice but to intervene and fight inflation. Also, Iranian nuclear discussions continue to tease with the promise of increased crude supplies. These two bearish factors are set against the overall global fuel supply situation. As Igor Sechin, the leader of Russian oil giant Rosneft, said on Saturday, “Long-term stability of oil supply is at risk due to underinvestment”. The Bears won Monday, but they need more than Iranian oil and Fed speculation to hold back the Bulls for long.

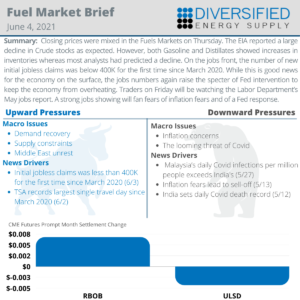

Closing prices were mixed in the Fuels Markets on Thursday. The EIA reported a large decline in Crude stocks as expected. However, both Gasoline and Distillates showed increases in inventories whereas most analysts had predicted a decline. On the jobs front, the number of new initial jobless claims was below 400K for the first time since March 2020. While this is good news for the economy on the surface, the jobs numbers again raise the specter of Fed intervention to keep the economy from overheating. Traders on Friday will be watching the Labor Department’s May jobs report. A strong jobs showing will fan fears of inflation fears and of a Fed response.

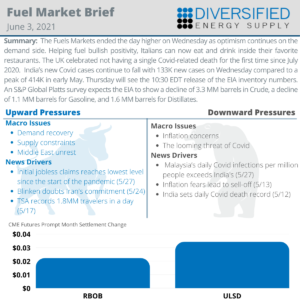

The Fuels Markets ended the day higher on Wednesday as optimism continues on the demand side. Helping fuel bullish positivity, Italians can now eat and drink inside their favorite restaurants. The UK celebrated not having a single Covid-related death for the first time since July 2020. India’s new Covid cases continue to fall with 133K new cases on Wednesday compared to a peak of 414K in early May. Thursday will see the 10:30 EDT release of the EIA inventory numbers. An S&P Global Platts survey expects the EIA to show a decline of 3.3 MM barrels in Crude, a decline of 1.1 MM barrels for Gasoline, and 1.6 MM barrels for Distillates.

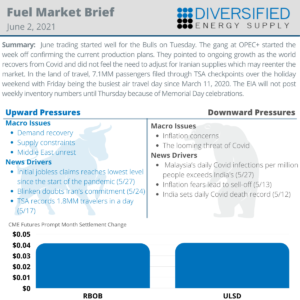

June trading started well for the Bulls on Tuesday. The gang at OPEC+ started the week off confirming the current production plans. They pointed to ongoing growth as the world recovers from Covid and did not feel the need to adjust for Iranian supplies which may reenter the market. In the land of travel, 7.1MM passengers filed through TSA checkpoints over the holiday weekend with Friday being the busiest air travel day since March 11, 2020. The EIA will not post weekly inventory numbers until Thursday because of Memorial Day celebrations.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075