Home > Archives for Randy Grizzle > Page 11

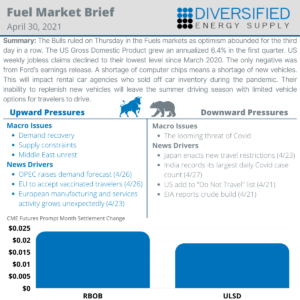

The Bulls ruled on Thursday in the Fuels markets as optimism abounded for the third day in a row. The US Gross Domestic Product grew an annualized 6.4% in the first quarter. US weekly jobless claims declined to their lowest level since March 2020. The only negative was from Ford’s earnings release. A shortage of computer chips means a shortage of new vehicles. This will impact rental car agencies who sold off car inventory during the pandemic. Their inability to replenish new vehicles will leave the summer driving season with limited vehicle options for travelers to drive.

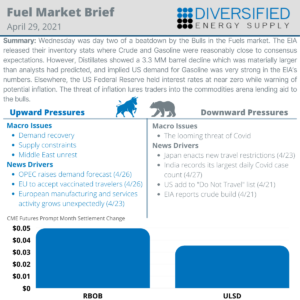

Wednesday was day two of a beatdown by the Bulls in the Fuels market. The EIA released their inventory stats where Crude and Gasoline were reasonably close to consensus expectations. However, Distillates showed a 3.3 MM barrel decline which was materially larger than analysts had predicted, and implied US demand for Gasoline was very strong in the EIA’s numbers. Elsewhere, the US Federal Reserve held interest rates at near zero while warning of potential inflation. The threat of inflation lures traders into the commodities arena lending aid to the bulls.

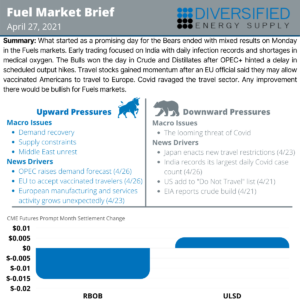

What started as a promising day for the Bears ended with mixed results on Monday in the Fuels markets. Early trading focused on India with daily infection records and shortages in medical oxygen. The Bulls won the day in Crude and Distillates after OPEC+ hinted a delay in scheduled output hikes. Travel stocks gained momentum after an EU official said they may allow vaccinated Americans to travel to Europe. Covid ravaged the travel sector. Any improvement there would be bullish for Fuels markets.

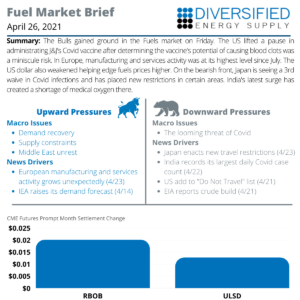

The Bulls gained ground in the Fuels market on Friday. The US lifted a pause in administrating J&J’s Covid vaccine after determining the vaccine’s potential of causing blood clots was a miniscule risk. In Europe, manufacturing and services activity was at its highest level since July. The US dollar also weakened helping edge fuels prices higher. On the bearish front, Japan is seeing a 3rd waive in Covid infections and has placed new restrictions in certain areas. India’s latest surge has created a shortage of medical oxygen there.

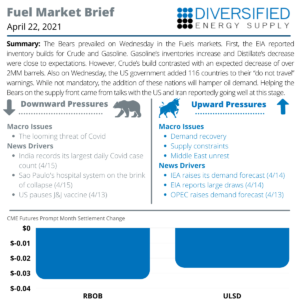

The Bears prevailed on Wednesday in the Fuels markets First, the EIA reported inventory builds for Crude and Gasoline. Gasoline’s inventories increase and Distillate’s decrease were close to expectations. However, Crude’s build contrasted with an expected decrease of over 2MM barrels. Also on Wednesday, the US government added 116 countries to their “do not travel” warnings. While not mandatory, the addition of these nations will hamper oil demand. Helping the Bears on the supply front came from talks with the US and Iran reportedly going well at this stage.

Talk to a Diversified Expert about how we can help you solve most complicated fuel supply chain challenges.

Email: info@diversified.energy

Phone: 404-474-4450

Dispatch Operations – Coverage 24/7

404-474-4767

M-F: 8:00 AM – 5:00 PM EST

Location

601 West Crossville Road

Roswell, Georgia 30075